Rates will continue to rise as part of the ACT’s tax reform program, as stamp duty reduces. Photo: File.

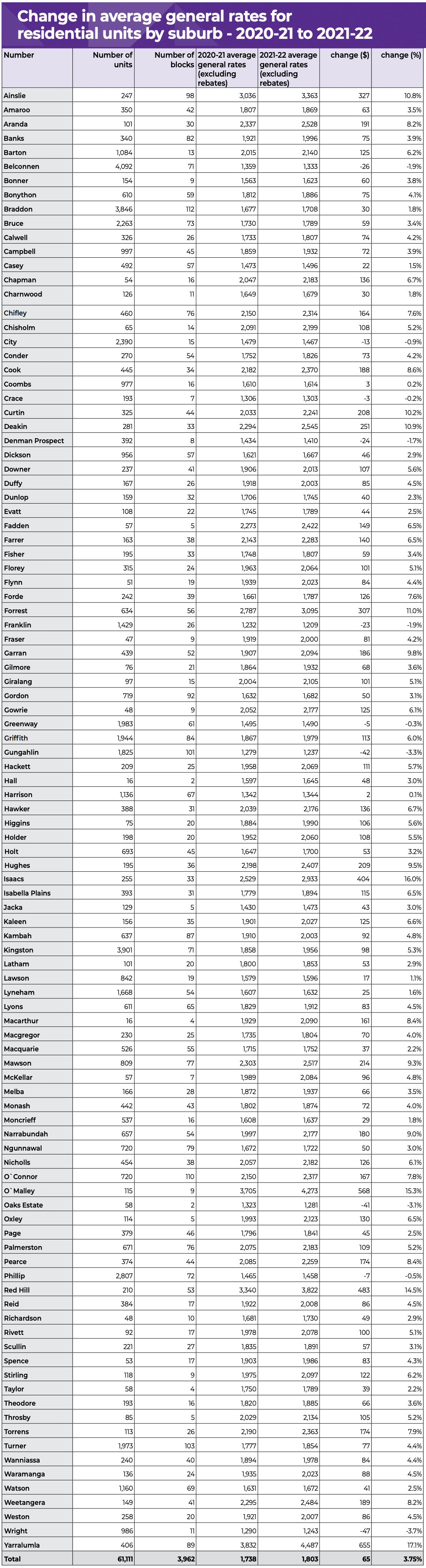

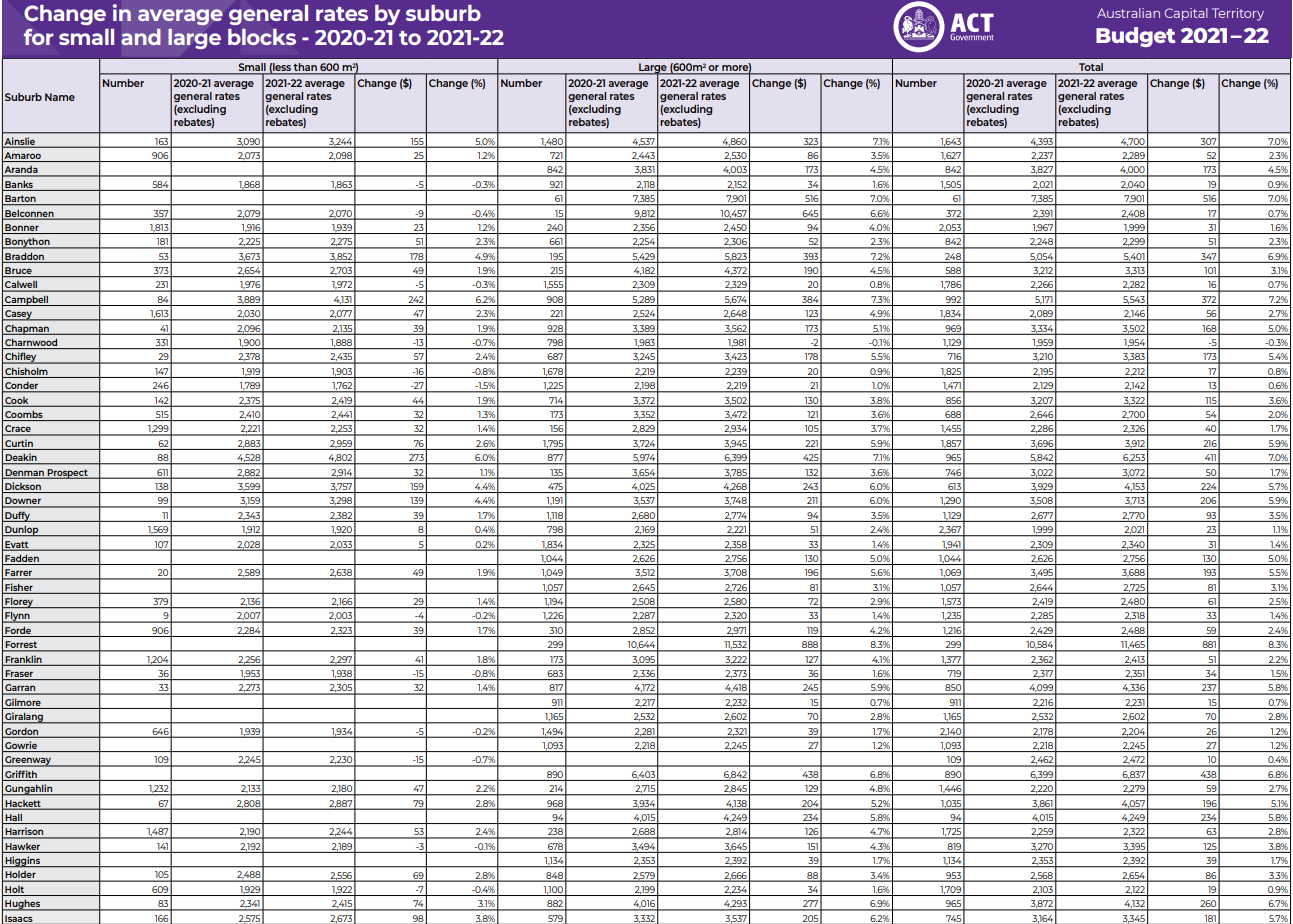

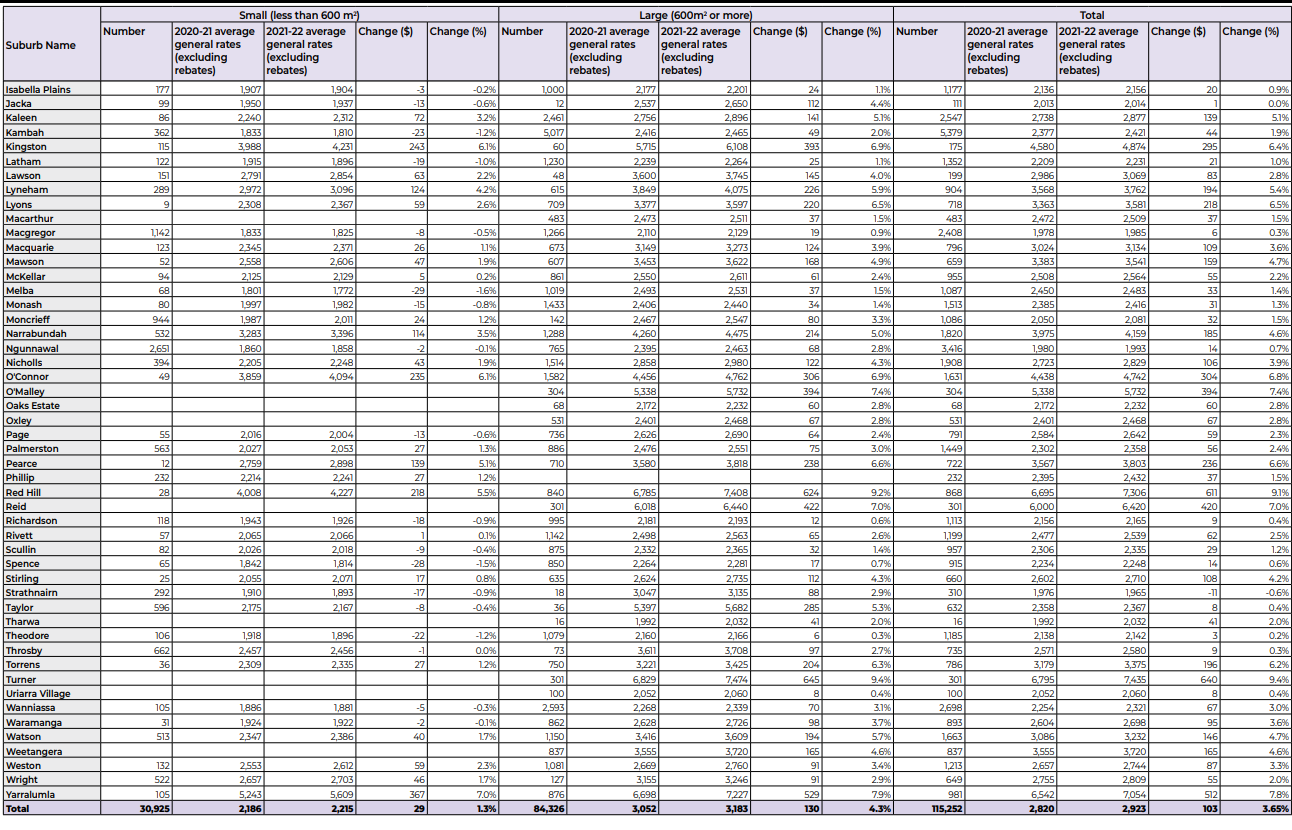

The ACT Budget shows a 3.75 per cent average increase in residential rates for both units and houses, but rises will vary widely across the Territory depending on the type, size and location of the property.

The tables below supplied by the ACT Government show your new annual rates bill and how much it may have changed.  Notes:

Notes:

Average rates do not factor in pensioner or COVID assistance general rates rebates.

Suburbs with five or fewer rateable properties are excluded, to protect tax payer privacy.

land size b" width="1292" height="830" />

land size b" width="1292" height="830" />

Notes:

Categories with five or fewer rateable properties are excluded, to protect tax payer privacy. Total number of rateable properties by suburb has been adjusted accordingly; suburb numbers do not sum to total numbers for the Territory.

General rates averages are for non-unit titled residential blocks with AUVs under $4 million. Larger value properties do not represent of general rates paid by houses as they include properties like large developments, retirement villages, and public housing.

Increase in total average rates is less than 3.75 per cent as residential blocks with AUVs above $4 million are excluded.

Average rates do not factor in pensioner or COVID assistance general rates rebates.